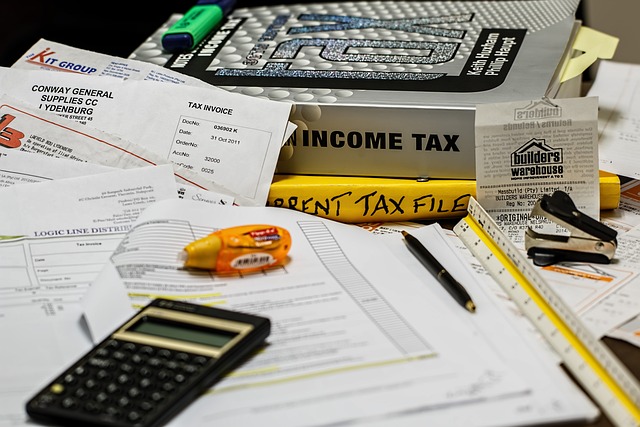

Tax Reform Complexity

The US tax code is complex. I don’t think there’s any argument here. We even have entire industries to address this complexity. Tax attorneys and tax accountants come to mind, then there’s all the federal employees required to enforce this. How did we get here? Why is this so complex?

Tax Code Length

The US tax code as of 2024 was 6,871 pages long. That’s bad enough, but it doesn’t stop there. The IRS also publishes official guidelines to implement this tax code and the Treasury Department also has it’s own regulations. The IRS publication and the Treasury’s add another approximately 68,129 pages. This brings our total documentation to roughly 75,000 pages. Not exactly something to have on the nightstand. Jeez

Purpose of US graduated Tax

In theory, the objective is simple. Here’s the reasoning behind the US having a graduated tax.

The goal of this system is to distribute the tax burden more equitably among taxpayers of varying income levels. It is guided by a social equity principal: Taxpayers with a higher ability to pay should contribute more towards the public treasury.Feb 16, 2024

Wrap it Up

The US tax code, in my opinion, needs serious reform. I don’t think we’re meeting the objective stated above and I also believe it’s directly related to the complexity, specifically the length of the documentation. Who can afford to hire tax attorneys and tax accountants? Even if the average citizen could hire the experts, I suspect we still wouldn’t get the write offs because the average citizen (non-corporation) is not allowed anywhere near the amount of write offs of corporations. Just chew on that for awhile.

There’s a lot to delve into if this topic interests you. Some call for a flat tax, others a modified graduated tax and I’m sure there’s other ideas as well. Point is the existing system doesn’t work. The problem as I see it is directly related to government, or in this case way to much government intervention. Put the government in charge and more times than not you end up with this. A huge set of regulations from multiple departments which confuses more than anything else. Jeez, talk about job security.